The gross GST revenue collected in the month of December 2020 is ₹ 1,15,174 crore of which CGST is ₹ 21,365 crore, SGST is ₹ 27,804 crore, IGST is ₹ 57,426 crore (including ₹ 27,050 crore collected on import of goods) and Cess is ₹ 8,579 crore (including ₹ 971 crore collected on import of goods). The total number of GSTR-3B Returns filed for the month of November up to 31st December 2020 is 87 lakhs.

The government has settled ₹ 23,276 crore to CGST and ₹ 17,681 crore to SGST from IGST as regular settlement. The total revenue earned by Central Government and the State Governments after regular settlement in the month of December 2020 is

₹ 44,641 crore for CGST and ₹ 45,485 crore for the SGST.

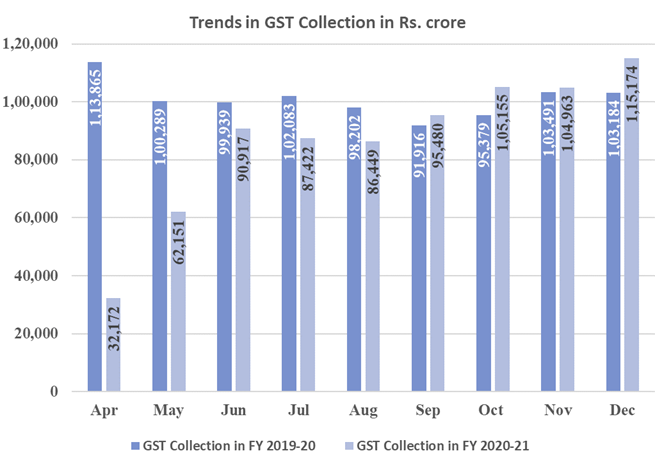

In line with the recent trend of recovery in the GST revenues, the revenues for the month of December 2020 are 12% higher than the GST revenues in the same month last year. During the month, revenues from import of goods was 27% higher and the revenues from domestic transaction (including import of services) are 8% higher that the revenues from these sources during the same month last year.

The GST revenues during December 2020 have been the highest since the introduction of GST and it is the first time that it has crossed ₹ 1.15 lakh crore. The highest GST collection till now was ₹ 1,13,866 crore in the month of April 2019. The revenues of April normally tend to be high since they pertain to the returns of March, which marks the end of financial year. The December 2020 revenues are significantly higher than last month’s revenues of ₹ 1,04.963 crore. This is the highest growth in monthly revenues since last 21 months. This has been due to combined effect of the rapid economic recovery post pandemic and the nation-wide drive against GST evaders and fake bills alongwith many systemic changes introduced recently, which have led to improved compliance.

Till now, GST revenues have crossed ₹ 1.1 lakh crore three times since introduction of GST. This is the third month in a row in the current financial year after the economy has been showing signs or recovery post pandemic that the GST revenues have been more than ₹ 1 lakh crore. The average growth in GST revenues during the last quarter has been 7.3% as compared to (-) 8.2% during the second quarter and

(-) 41.0% during the first quarter of the financial year.

The chart below shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during the month of December 2020 as compared to December 2019.

State-wise growth of GST Revenues during December 2020[1]

| State | Dec-19 | Dec-20 | Growth | |

| 1 | Jammu and Kashmir | 409 | 318 | -22% |

| 2 | Himachal Pradesh | 699 | 670 | -4% |

| 3 | Punjab | 1,290 | 1,353 | 5% |

| 4 | Chandigarh | 168 | 158 | -6% |

| 5 | Uttarakhand | 1,213 | 1,246 | 3% |

| 6 | Haryana | 5,365 | 5,747 | 7% |

| 7 | Delhi | 3,698 | 3,451 | -7% |

| 8 | Rajasthan | 2,713 | 3,135 | 16% |

| 9 | Uttar Pradesh | 5,489 | 5,937 | 8% |

| 10 | Bihar | 1,016 | 1,067 | 5% |

| 11 | Sikkim | 214 | 225 | 5% |

| 12 | Arunachal Pradesh | 58 | 46 | -22% |

| 13 | Nagaland | 31 | 38 | 23% |

| 14 | Manipur | 44 | 41 | -8% |

| 15 | Mizoram | 21 | 25 | 21% |

| 16 | Tripura | 59 | 74 | 25% |

| 17 | Meghalaya | 123 | 106 | -14% |

| 18 | Assam | 991 | 984 | -1% |

| 19 | West Bengal | 3,748 | 4,114 | 10% |

| 20 | Jharkhand | 1,943 | 2,150 | 11% |

| 21 | Odisha | 2,383 | 2,860 | 20% |

| 22 | Chhattisgarh | 2,136 | 2,349 | 10% |

| 23 | Madhya Pradesh | 2,434 | 2,615 | 7% |

| 24 | Gujarat | 6,621 | 7,469 | 13% |

| 25 | Daman and Diu | 94 | 4 | -96% |

| 26 | Dadra and Nagar Haveli | 154 | 259 | 68% |

| 27 | Maharashtra | 16,530 | 17,699 | 7% |

| 29 | Karnataka | 6,886 | 7,459 | 8% |

| 30 | Goa | 363 | 342 | -6% |

| 31 | Lakshadweep | 1 | 1 | -32% |

| 32 | Kerala | 1,651 | 1,776 | 8% |

| 33 | Tamil Nadu | 6,422 | 6,905 | 8% |

| 34 | Puducherry | 165 | 159 | -4% |

| 35 | Andaman and Nicobar Islands | 30 | 22 | -26% |

| 36 | Telangana | 3,420 | 3,543 | 4% |

| 37 | Andhra Pradesh | 2,265 | 2,581 | 14% |

| 38 | Laddakh | 0 | 8 | |

| 97 | Other Territory | 118 | 88 | -25% |

| 99 | Center Jurisdiction | 75 | 127 | 68% |

| Grand Total | 81,042 | 87,153 | 8% | |

[1] Does not include GST on import of goods